March's Market Insights

Cautious recovery continues but larger-home sales lag behind

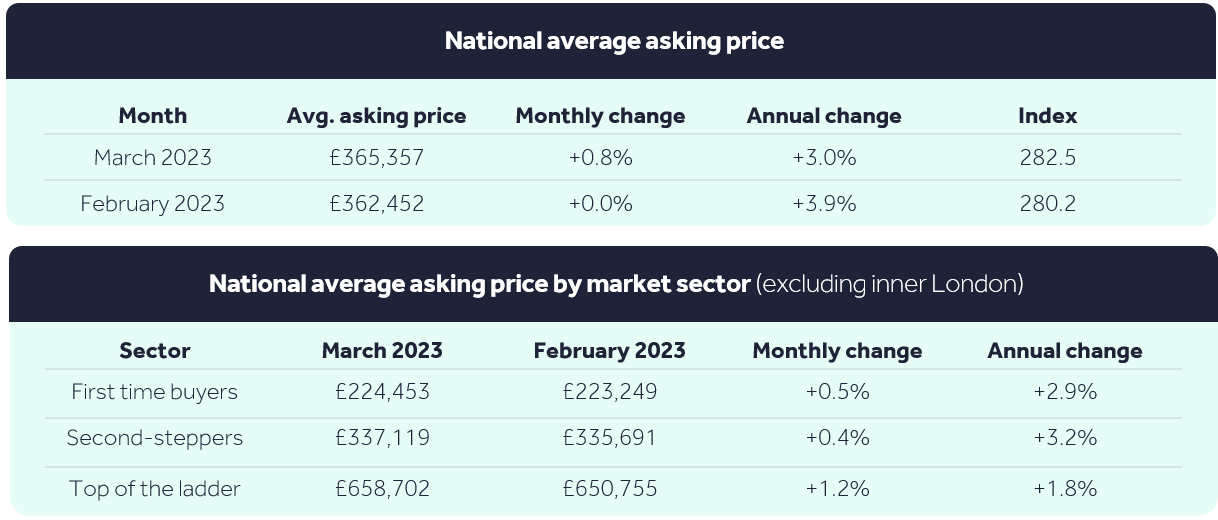

- The average price of property coming to market rises by 0.8% (+£2,906) this month, mainly due to a 1.2% jump in the largest homes sector (top-of-the-ladder):

- Annual asking price growth eases to +3.0%, with new seller asking prices now £5,800 below October’s peak as market cautiously moves towards pre-pandemic activity levels despite economic turbulence

- Typical first-time buyer type properties (two-bedrooms and fewer) lead the recovery as we enter spring market:

- Average newly marketed prices for this type of home are now just £500 lower than their record last year

- Sales agreed in this sector are unexpectedly recovering fastest, and in the last two weeks are just 4% behind the same period in the more normal market of 2019, though 18% behind the exceptional 2022

- However, larger home sales are lagging behind as sales agreed in the last two weeks in the top-of-the-ladder sector are 10% behind the same period in 2019, and 13% behind in the second-stepper sector

- Average mortgage rates have fallen back from their peak last year, with average rates for a 15% deposit five-year fixed mortgage now 4.65%, edging down from last month’s 4.75%, and October’s 5.89%, though this compares to 2.48% in March 2022

The average price of property coming to the market rises by 0.8% (+2,906) this month to £365,357. This is below the average monthly rise of 1.0% seen in March over the last 20 years, reflecting a higher degree of pricing caution by many new sellers than is usually seen at this time of year. The exception to this caution is a 1.2% monthly price jump in the larger home top-of-the-ladder sector, in contrast to more modest 0.4% and 0.5% respective rises in the first-time buyer and second-stepper sectors. Overall, new seller asking prices are now £5,800 below October 2022’s peak, with annual price growth continuing to ease and now at +3.0%. The data continues to point to a market on a much more stable footing than many anticipated and cautiously transitioning towards the activity levels of the more normal market of 2019.

“The beginning of the spring season sees stability and confidence continuing to return to the market as it recovers from the turbulence at the end of 2022. The pace of the market reached an unsustainable level in the last two years, and was on track to slow to a more normal level, though the speed of this slowdown to more normality was accelerated by the reaction to September’s mini-Budget. While higher mortgage rates and economic headwinds raise challenges, many potential home movers who were effectively side-lined in the frenetic bidding wars of the last two years will find that a slower-paced market gives them time to plan and secure their next move as we enter the traditionally busy spring-buying season.“

Tim Bannister Rightmove’s Director of Property Science

Typical first-time buyer type properties (two-bedrooms and fewer) are leading a cautious recovery, with sales agreed in this sector improving fastest. In the last two weeks, agreed sales are just 4% behind the same period in the more normal market of 2019. However, to put this into context they are 18% behind last year’s exceptional level. The result of this increased buyer activity means that average asking prices for first-time buyer type properties are now remarkably just £500 lower than their peak last year. Given the rising cost of living and increased cost of taking out a mortgage, it is likely that many in this group are getting some support from family or have been able to avoid record rents and saved up a larger deposit by living with parents for longer.

By contrast and highlighting the current hyper-local and market sector differences, sales agreed in the last two weeks in the more discretionary top-of-the-ladder and second-stepper homes sectors are 10% and 13% behind the same period in 2019 respectively. However, while the modest 0.4% rise in average second-stepper asking prices reflects this more muted level of activity, the 1.2% rise in the most expensive property sector appears to be over-optimistic given the slower recovery in sales agreed numbers, and some sellers in this sector may need to temper their price expectations in order to attract more buyer interest and secure a sale. One contributing factor to larger home sales lagging is a reduction in pandemic-driven lifestyle changes. The proportion of buyers enquiring to make a move over 50km away from where they live is now 15%, the same level as 2019 and below its pandemic peak of 18%.

Mortgage rates have fallen back from their peak last year, with average rates for a 15% deposit five-year fixed mortgage now 4.65%, edging down from last month’s 4.75%, and October’s 5.89%, though this compares to 2.48% this time last year. Accompanying the budget announcement, the OBR statement that inflation is likely to reduce more quickly than previously forecast to 2.9% by the end of 2023 is positive news and the Bank of England may temper rate rises and reduce them more quickly than previously anticipated. However, market conditions are changeable, and we will need to see how the mortgage market reacts in the coming weeks.

“Lagging sales agreed in the larger homes sectors are likely to be caused by a combination of factors including fewer pandemic-driven moves to bigger homes, a more cautious approach to trading up due to the cost of living, and even perhaps concern over the running costs of a larger home. Meanwhile sales in the first-time buyer sector are likely being helped by some deposit assistance from family. The differing performance of smaller and larger homes highlights the multi-speed, hyper-local market. Sellers looking to take advantage of traditionally strong buyer interest during the spring moving season should seek the expertise of a local estate agent, who will have their finger on the pulse and be best placed to advise on their local market.“

Tim Bannister Rightmove’s Director of Property Science

|

Click Here to read the House Price Index |